The cryptocurrency world lives on transparency, trust, and community-driven initiatives. However, the recent controversy surrounding Gifto (GFT) has shaken investor confidence. Reports revealed that 1.2 billion Gifto tokens were minted without prior announcement, triggering a sharp decline in the token’s price. This unexpected move is something that has generated a heated debate among investors and crypto enthusiasts about the implications for the future of the project, whether the token minting was ethical or not, and the effect on market stability. This article explores reasons why the controversy occurred, its effects on the Gifto ecosystem, and its significance to the broader crypto industry.

The Controversial Token Minting Incident

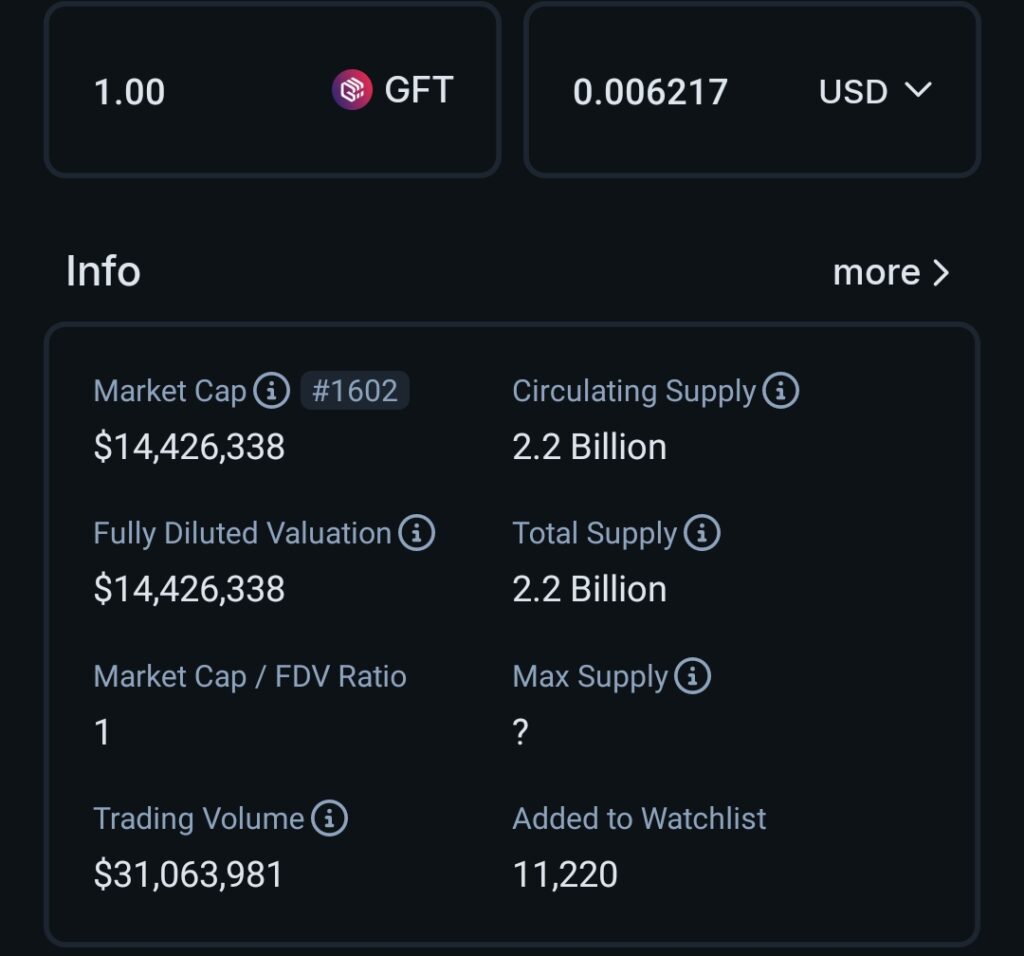

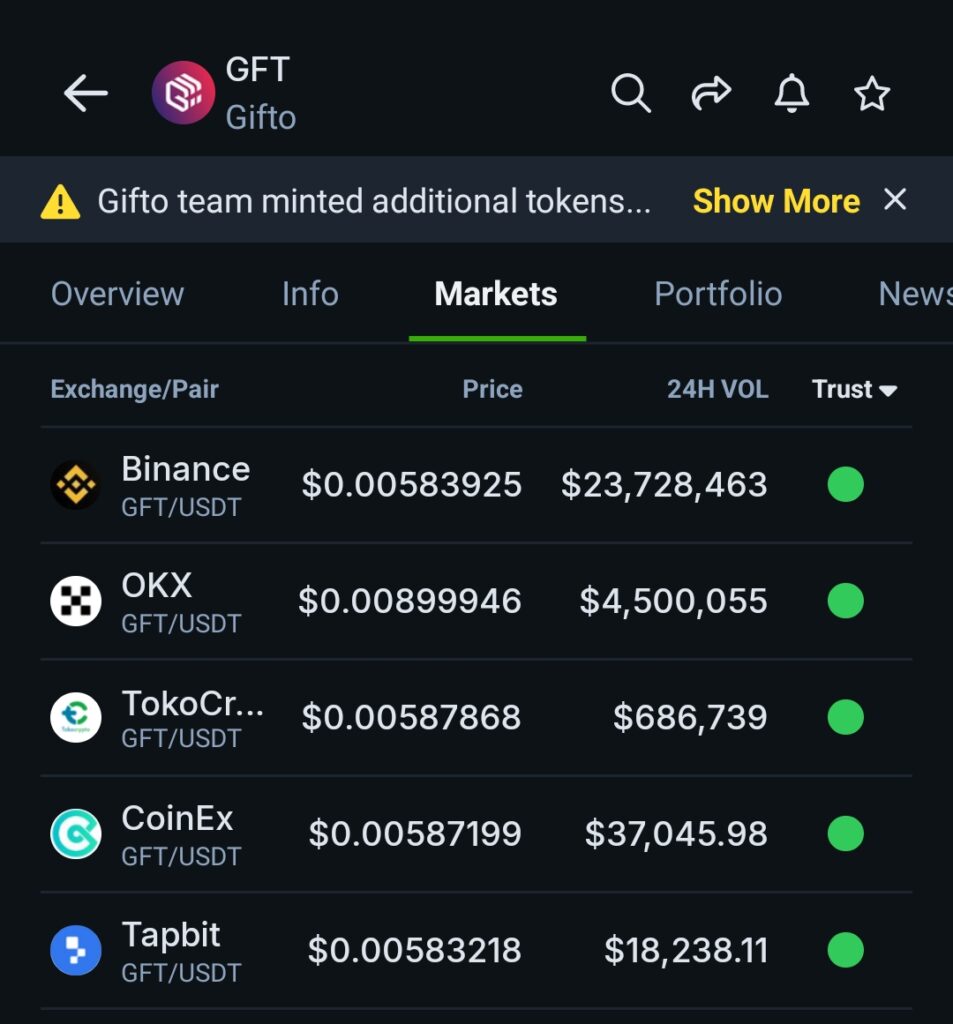

Gifto is a blockchain-based project that allows for digital gifting using cryptocurrency. It was severely attacked when 1.2 billion tokens were minted without prior notice to its community. Token minting is a sensitive operation since it directly affects the supply of a token and, by consequence, its value in the market. The secretive process of minting led to speculations that insiders had manipulated the minting for their personal benefit or have misused funds. This raises questions of lack of accountability, contrary to what the blockchain community usually claims for a decentralized cause.

The event further created worries due to its timing. Already, the crypto market was undergoing volatility, and a sudden injection of supply of GFT caused its price to sharply decline. Investors quickly saw their holdings lose value, with widespread panic selling. While the Gifto team subsequently explained that this minting was targeted towards project development and ecosystem growth, this had no apparent holding value in advance. Many believe such decisions should be community consulted or, at least, timely disclosed to prevent unnecessary market shocks.

Immediate Effect on Gifto Price and Market Confidence

The immediate aftermath of the unannounced minting was a precipitous drop in the price of Gifto’s token. All types of investors, including retail and institutional investors, expressed shock at the sudden increase in supply. The basic principles of economics are that when supply rises without an equivalent increase in demand, prices will fall. This is exactly what transpired with Gifto; the surprise minting diluted the value of existing tokens.

Market confidence in Gifto also suffered a serious blow. Trust, in fact, is the backbone of every cryptocurrency project, and the perceived lack of it by the Gifto team has left many investors doubtful about the long-term sustainability of the project. Social media on Twitter and Reddit was filled to the brim with posts of frustrated investors complaining about the failure to communicate. This negative message further fueled the sell-off as it added to the already downward trend of the price. For most, this incident revealed risks in investing in smaller or less-established crypto projects, perhaps not maintaining the standards that this industry expects of transparency.

Community Reactions and Damage Control Efforts

The Gifto community, a strong supporter of the project, was swift to voice its concern. Many users accused the team of prioritizing their interests over the interest of the community. Some even speculated that the minting could have been a prelude to a “rug pull,” whereby developers abandon a project after taking out all the value from it. Although such claims are not verified, they show how deep mistrust has been sown among investors by this incident.

In response, the Gifto team issued a statement explaining the rationale behind the token minting. They emphasized that the additional tokens were meant to fund ongoing development, partnerships, and marketing efforts. However, for many, this explanation came too late. Transparency is not just about the actions taken but also about timely communication, and the delay in addressing the issue only worsened the situation. Such perceptions have had some community members suggest conducting independent audits of the project to redeem confidence while, on the other hand, most have changed their investments over worries for further surprise.

The price of Gifto (GTO), the token of a decentralized gifting platform, has dropped by as much as 35% following reports that the project’s team secretly minted 1.2 billion additional tokens. The sudden influx of tokens into the market led to a sharp devaluation of the cryptocurrency, raising red flags among investors and the broader community about the project’s transparency and long-term viability.

The Token Minting Controversy

Gifto, which had initially made headlines for its blockchain-based gifting platform, has been in the spotlight lately due to the sudden emergence of a huge amount of new tokens on various exchanges. According to sources close to the situation, the team behind Gifto minted 1.2 billion tokens without prior announcement, flooding the market and significantly increasing the circulating supply.

This move was unexpected and enraged the Gifto community due to its previous promise of following the transparent tokenomics model. The sudden surge in supply is thought to be one of the main contributors to the sharp fall in the value of the token.

Market Impact

The minting of 1.2 billion tokens has generated an oversupply of GTO in the market; normally, this leads to a drop in price. The price of Gifto fell by 35 percent within a few hours after allowing the tokens to be traded on platforms. Many investors have subsequently lost huge sums of money as the token had flopped sharply, especially as some had invested in the idea of its long-term profitability.

Community Backlash and Responses

The Gifto community has expressed high discontent with the actions of the team. Many members are outraged by the lack of transparency in the decision to mint a large number of tokens without consulting the community or prior notice. Social media and forums for cryptocurrencies have been abuzz with heated discussions over the ethical implications of such acts, and the long-term damage that this may have to the reputation of the project.

Some investors have demanded that the team provide an official explanation about the minting, most questioning whether the actions were of a deliberate plan to siphon wealth from regular investors into insiders.

What Will This Mean for Gifto’s Future?

The future of Gifto is uncertain as a result of the recent controversy about token minting. Any blockchain project requires trust; hence, the team’s failure to communicate this could have long-lasting effects on investor confidence.

So far, investors are left to their own devices navigating this surprise devaluation. Most investors are selling off whatever holdings they have in Gifto to avoid further loss. Whether Gifto will survive or not is contingent on how the team handles this situation and rebuilds the community’s trust.

The price drop also raises a bigger question about the transparency of other blockchain projects and their handling of tokenomics. Investors and analysts will likely be closely monitoring the situation to determine whether Gifto can recover or if this will mark the beginning of its decline.

Conclusion/Recommendation

The Gifto incident will be a cautionary tale for the wider cryptocurrency space. Transparency and trust are essential for investor confidence, and the Gifto case highlights that fact. In a completely unregulated market like that of cryptocurrencies, projects are very much in charge of their activities. However, with this comes the burden of responsibility for proper ethical behavior. Cases such as Gifto undermine the credibility of the entire industry and provide regulators with ammunition to push for stricter oversight.

To investors, this incident points out the importance of due diligence. One needs to research a team, roadmap, and history before committing fund. Even red flags like bad communication or unclear tokenomics should not be ignored. The Gifto scandal reminds developers of the risks of alienating their community. Open and transparent communication, especially on sensitive matters like token minting, can go a long way in building trust and ensuring long-term success.

Conclusion

Unannounced minting of 1.2 billion Gifto tokens has left a deep scar on the project and community. The team’s intentions to grow the project may have been right, but their failure in effective communication led to tremendous financial and reputational damage. This case is a strong reminder to maintain openness and high standards of morality within the space of cryptocurrencies. Such incidents will naturally create a stir towards better accountability as the sector of cryptocurrency is expanding and getting more mature with each passing day. For Gifto, redemption will not be easy; however, with good intent in re-establishing trust, it might regain that. For now, however, it stands as a powerful example of the consequences of neglecting community trust in the volatile world of cryptocurrency.