The cryptocurrency mining industry is constantly evolving due to market forces, regulatory changes, and advances in technology. The latest news emanating from one of the industry’s major players has involved Foundry, the significant BTC miner, making the announcement of cutting its workforce drastically. This is part of its new strategy to concentrate intensely on its core Bitcoin mining operations.

This article explores the reasons for Foundry’s restructuring, its implications on the crypto mining sector, and the general significance of this move in the developing Bitcoin ecosystem.

Understanding Foundry’s Role in the Crypto Mining Industry

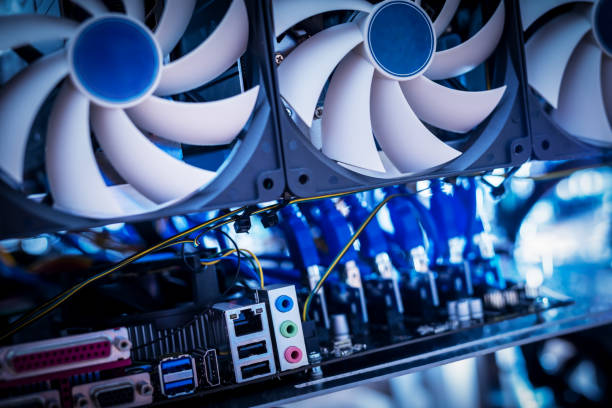

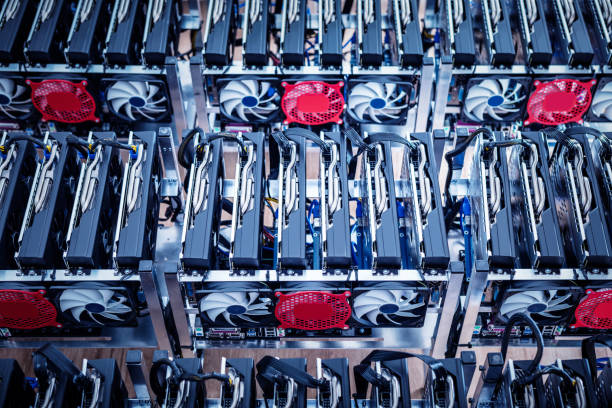

Foundry is a subsidiary of the Digital Currency Group (DCG), a conglomerate that has its roots deeply embedded in the cryptocurrency space. Foundry has become a leader in Bitcoin mining infrastructure and services. It provides mining equipment, financial services, and access to mining pools, making it a critical player in the ecosystem.

Foundry has become prominent, especially with its Foundry USA Pool ranking often among the top pools globally by hash rate. This supremacy reflects the power of the infrastructure, cutting-edge technology, and adaptability to a volatile crypto environment.

However, due to the prolonged bear markets in 2023 and 2024 and increasing operational costs, the regulatory landscape that kept changing has challenged many organizations to reevaluate their priorities, as in the case of Foundry.

The Workforce Cuts: A Strategic Decisión

In its recent announcement, Foundry confirmed a decision to significantly downsize its workforce. While this may seem drastic, it aligns with the company’s strategy to channel resources into its core Bitcoin mining operations. Let’s explore the factors driving this decision:

1. Market Pressures and Profitability ConcernsThis makes volatility in the crypto market a direct hit on profitability in mining companies. The decline in the price of Bitcoin in a bear market reduces miners’ revenues. Coupled with energy costs and increased mining difficulty, the operational margins are heavily pressed upon companies like Foundry.

2. Focus on Core CompetenciesFoundry’s move to cut down on peripheral activities and focus solely on Bitcoin mining reflects its will to optimize its operations. The company can better utilize resources by eliminating less crucial roles in a market that has been growing in saturation.

3. Regulatory UncertaintyIn terms of regulatory scrutiny in major markets such as the United States, it has become very challenging for mining firms to strategize long-term. Perhaps, Foundry’s restructuring may have resulted from this uncertainty to be more flexible and to react accordingly to changes in policies.

4. Technological advancementsThe Bitcoin mining industry requires a huge amount of capital infusion, and there is always an increasing need to upgrade the mining machines. In this regard, Foundry can focus on the core operations and invest in next-generation mining hardware promising better efficiency and profitability.

Implications for the Crypto Mining Industry

Reduction in the workforce in Foundry is not an event in isolation but part of a broader trend in the crypto mining sector. How it may influence the industry:

1. Increased ConsolidationSmaller players facing the high costs and squeezed margins either leave the market or are forced to merge with the bigger firms, like Foundry. This might result in a small number of stronger players within the Bitcoin mining ecosystem.

2. Sustainable FocusThe downsizing indicates the financial problematics of crypto mining, which is prevalent in high-energy-cost areas. The firms would take more renewable energy sources and highly efficient energy technologies to sustain themselves.

3. Global Hash Rate DistributionThe Foundry’s dominance in the global Bitcoin hash rate has been strong. A leaner, more focused Foundry would increase its market share, changing the global geographical distribution of Bitcoin mining power.

4. Impact on Jobs and Local EconomiesWorkforce cuts typically trickle down to local economies that have host companies for crypto miners. For Foundry, it will be a wake-up call to governments and stakeholders operating in this industry to rethink how to support and regulate the activities.

Challenge in Bitcoin Mining: A Wider Scope

Bitcoin mining faces significant challenges other than Foundry’s restructure process:

1. Consumption of Energy and Environmental ChallengesBitcoin mining is a power guzzler, and most environmental activists criticize it. Companies are being forced to adopt greener practices, which increases the cost of operations.

2. Increased CompetitionThe introduction of more efficient mining equipment and new players in the market has increased competition. It requires constant innovation and huge investment to stay ahead.

3. Economic PressuresGlobal economic uncertainties, including inflation and fluctuating energy prices, directly impact mining costs. Companies like Foundry must navigate these challenges while maintaining profitability.

Opportunities Amidst Challenges

Despite these challenges, the Bitcoin mining sector holds significant opportunities for growth:

1. Next-Generation Mining HardwareInvestments in ASIC miners, and other advanced technologies are believed to enhance efficiency and energy use.

2. Integration with Renewable EnergyThe integration with renewable energy sources addresses both the environmental and price volatility issues that characterise the use of other forms of energy.

3. Institutional DemandAs Bitcoin mining is slowly emerging as a legitimate asset class, it attracts institutional investors. Such developments bode well for a company like Foundry.

4. Emerging Market ExpansionsAs regulatory hurdles in developed markets increase, mining firms can explore opportunities in emerging economies with lower energy costs and supportive policies.

Foundry’s Restructuring in Context

The workforce reduction and renewed focus on core BTC mining operations are emblematic of the industry’s broader shift towards sustainability and efficiency. Foundry’s restructuring is not just a survival tactic but a strategic move to adapt to an evolving market.

Its parent company, Digital Currency Group, will also be influential in setting the future course of this company. Being a player in the crypto ecosystem, DCG’s support may give Foundry the kind of financial and strategic backing required to ride out this change.

Conclusion

Foundry’s downsizing of the workforce and its shift in concentration to core Bitcoin mining operations will be seen as a challenge and opportunity in the cryptocurrency mining industry. Though the move is a setback, it still reflects a commitment on the part of the company toward long-term sustainability and competitiveness.

As the crypto mining sector evolves, companies like Foundry will have to balance the quest for operational efficiency, technological innovation, and environmental responsibility. What decisions are made today will form the future of Bitcoin mining and its role in the global financial ecosystem.

Ultimately, the restructuring of Foundry is not cost-cutting but placing itself at the forefront of the next generation of Bitcoin mining. Indeed, the crypto world is keenly observing this strategy play out.