Altcoins in Focus: Current Trends and Insights for Traders

The last ten years witnessed a tremendous change in the crypto market. The cryptocurrency world’s pioneering digital asset has been Bitcoin, and this asset continues to maintain its dominance. Nevertheless, with the rise of altcoins, diverse investment opportunities, and use cases are offered. Some of these contenders include Solana (SOL), XRP, and Chainlink (LINK), each with innovations unique to it and satisfying different needs in the market, all within 2024. This article examines the latest trends surrounding these altcoins and provides actionable tips for investors in this evolving landscape.

Altcoins have emerged as a significant part of the cryptocurrency landscape, complementing the dominance of Bitcoin and Ethereum. While many altcoins follow the trends set by these giants, others are forging unique paths through innovative technology, partnerships, and market strategies. This article takes a deep dive into the altcoins currently in the spotlight, analyzing their performance, potential, and the trends driving their growth.

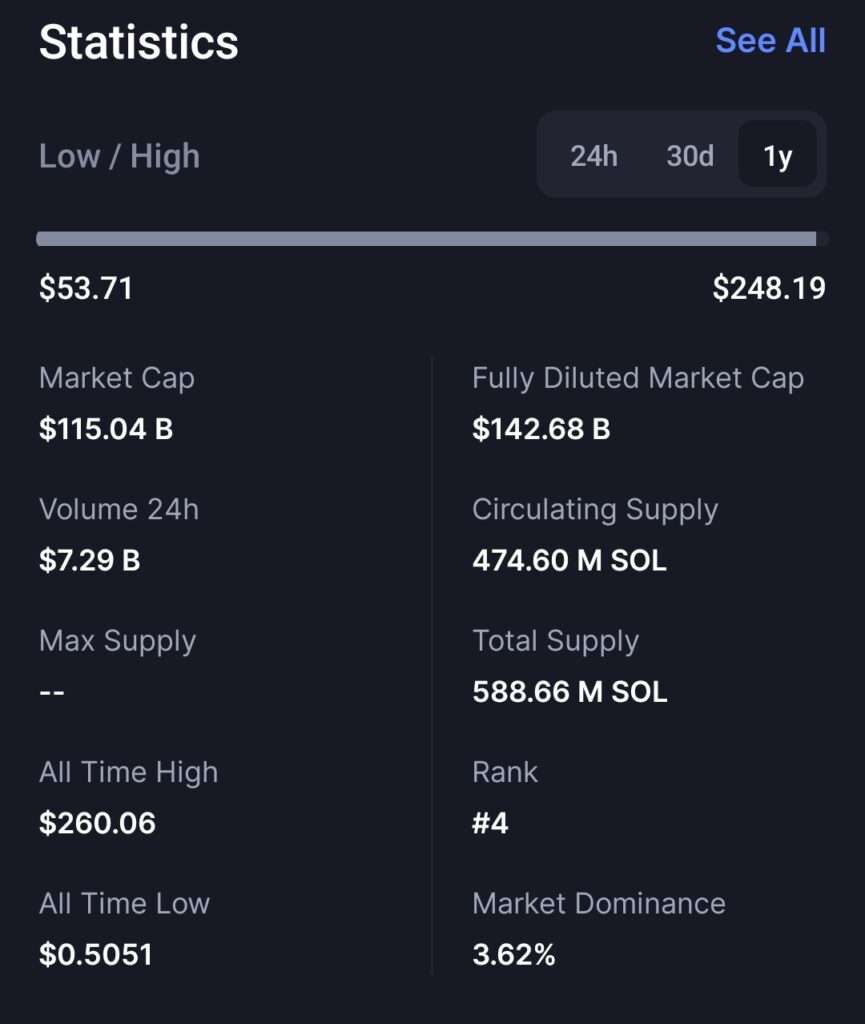

1. Solana (SOL): Riding High on Developer Activity

Solana has become a standout altcoin, consistently performing well and trading around the $65 mark. Known for its high-speed transactions and low fees, Solana is a favorite among developers for creating decentralized applications (dApps) and NFT projects.

Key Drivers for SOL’s Price RisedApps Adoption: Many developers are choosing Solana for its efficiency, leading to an ecosystem of innovative applications.

Solana, which is often called the “Ethereum killer,” has become one of the fastest and most scalable blockchains in the cryptocurrency market. Its high transaction throughput, low fees, and energy-efficient Proof-of-History (PoH) consensus mechanism make it a go-to platform for decentralized applications (dApps) and non-fungible tokens (NFTs). In 2024, Solana’s ecosystem has expanded exponentially with developers leveraging its speed to create innovative gaming, DeFi, and NFT projects.

The most striking trend has been the growing institutional interest into Solana, attributed to its capacity for handling thousands of transactions per second. Such scalability attracted significant partnerships with the likes of tech companies and investment firms interested in implementing blockchain solutions within their organizations. In the case of an investor, the expansion opportunity with Solana becomes immense with an expanding ecosystem but remains a threat by layer 1 blockchains emerging to take up such potential space.

Institutional Interest:

Institutional investors are showing confidence in Solana due to its scalability.

Partnerships in Gaming and Metaverse: Collaborations in the gaming and metaverse sectors have added to its appeal.

2. Ripple (XRP): Navigating Regulatory Waters

Ripple’s XRP has been highly acknowledged to be useful for facilitating cross-border transactions within the blink of an eye at little cost. Through the remainder of 2024, XRP resurfacing is tied more directly to the resolution of the U.S. Securities and Exchange Commission (SEC) against Ripple. Many positive rulings have provided badly needed regulatory clarity, giving comfort to investors and making XRP a reliable asset for investors in the crypto market.

The adoption of XRP by financial institutions has gained pace, especially in emerging markets where cross-border remittances are crucial. Ripple’s On-Demand Liquidity (ODL) solution, which employs XRP as a bridge currency, has been adopted by more banking systems, making international money transfers faster. For investors, this trend speaks to the long-term potential of XRP. However, market participants should keep track of regulatory developments and macroeconomic factors shaping the global payments sector.

Ripple continues to be a topic of discussion, primarily due to its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). Despite regulatory uncertainty, XRP has maintained its position as a top cryptocurrency, supported by its strong fundamentals and trading volume.

Why XRP Matters

Cross-Border Payments: Ripple’s technology facilitates seamless international transactions, attracting attention from the banking sector.

Legal Wins:

Partial victories in its legal case have boosted market sentiment.

Banking Demand:

Ripple is increasingly used in financial services, showcasing its utility.

3. Chainlink (LINK): Driving Smart Contract Innovation

Chainlink has emerged as a critical component of the decentralized finance (DeFi) ecosystem, providing reliable and tamper-proof oracle solutions that connect smart contracts with real-world data. In 2024, Chainlink’s importance is further amplified due to its role in enabling sophisticated financial instruments and automating complex business processes.

The introduction of staking mechanisms within the Chainlink network has been a game-changer, offering token holders an opportunity to earn passive income while contributing to the network’s security. Furthermore, the expansion of Chainlink’s services into sectors like insurance, gaming, and supply chain management has diversified its use cases, making it a versatile asset in the crypto space. Chainlink investors should keep their eyes on its staking and partnerships with traditional enterprises; these aspects can significantly impact the value proposition of the token.

Chainlink plays a pivotal role in the cryptocurrency ecosystem by connecting blockchain-based smart contracts with real-world data through its Oracle services. This unique utility has led to steady gains for LINK.

Blockchain Integration:

Chainlink’s Oracle services are integrated into multiple blockchain networks, increasing its relevance.

Financial Partnerships:

Collaborations with traditional financial institutions are opening new use cases.

Decentralized Data Demand: With the rise of decentralized finance (DeFi), the demand for reliable data feeds is growing.

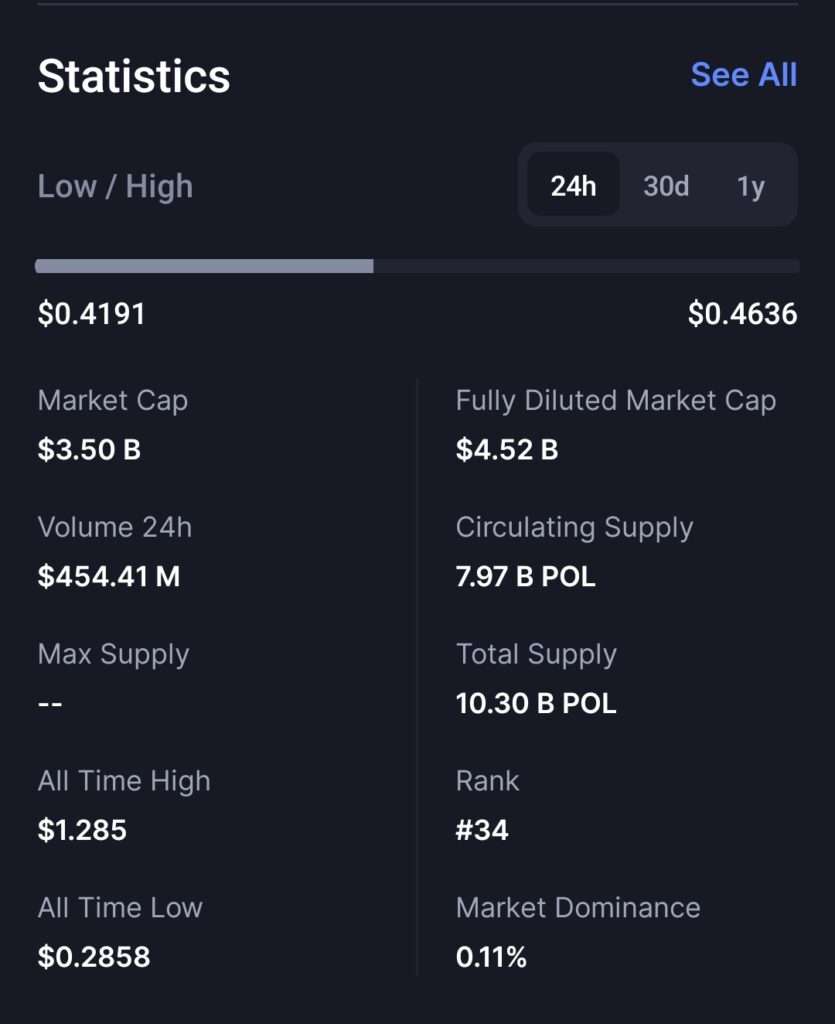

4. Polygon (MATIC):

Polygon has become a leader in scalability solutions, offering low-cost, high-performance alternatives to Ethereum. Its increasing network activity and major integrations, including partnerships with platforms like Reddit and Instagram, have driven MATIC’s steady price growth.

Low Fees:

Polygon offers a cost-effective solution compared to Ethereum.

Performance Improvements:

Ongoing developments aim to enhance scalability and speed.

Web 3 Adoption:

Major corporations are utilizing Polygon for their Web3 projects, solidifying its position.

5. Shiba Inu (SHIB) and Dogecoin (DOGE):

Meme coins like Shiba Inu and Dogecoin have surprised many with their resilience. Far from being just jokes, these coins have evolved into community-driven projects with real-world applications.

Community Backing:

Strong communities actively support SHIB and DOGE, creating sustained interest.

Unique Branding:

Their quirky nature continues to attract retail investors.

Expanding Utility:

Both coins are now being used in payment solutions and gaming projects.

Tips for Trading Altcoins

Trading altcoins can be profitable but requires a strategic approach. Here are some essential tips:

1. Research Fundamentals

Understand the underlying technology, team, and market potential of each altcoin.

2. Stay Updated

Follow breaking news on partnerships, regulatory changes, and technological advancements.

3. Diversify Portfolio

Spread your investments across high-risk and low-risk assets.

4. Use Technical Analysis

Identify support and resistance levels to determine the best entry and exit points.

Conclusion

The altcoins highlighted in this article—Solana, XRP, Chainlink, Polygon, and even meme coins like Shiba Inu and Dogecoin—demonstrate the diversity and potential within the cryptocurrency market. While they offer promising opportunities, trading altcoins requires careful research, continuous learning, and a clear strategy. With the right approach, these digital assets can play a valuable role in your investment portfolio.

Altcoin Investment Trends in the Future

Beyond Solana, XRP, and Chainlink, the altcoin market of 2024 is saturated with opportunities in almost all niches. Layer-2 solutions like Polygon (MATIC) are helping to solve the scalability problems on Ethereum, while AI-driven projects like SingularityNET (AGIX) are pushing the boundaries of blockchain applications. Meme coins like Shiba Inu (SHIB) and Dogecoin (DOGE) continue to be in the public eye, though their speculative nature demands caution.

Some of the key trends that can be witnessed here are that there is more convergence of AI with blockchain, as altcoins are being used to power decentralized AI networks. Likewise, tokenized assets like real estate and commodities have come into existence, making a new doorway for the entry of traditional investors in the crypto market. Therefore, for both retail and institutional players, the keys to success lie in researching it well, diversifying investment, and staying on top of technological and regulatory development.

Tips for Navigating the Altcoin Market in 2024

Altcoin investment can be lucrative, but it needs strategic planning. First, try to learn about the basic fundamentals of each project – its use case, the team behind it, and community support. Established track records in altcoins, such as Solana, XRP, and Chainlink, are a thing, but emerging projects have the same upside potential when they have innovative technology backing them.

Second, risk management is crucial in the volatile world of cryptocurrencies. You can distribute a part of your portfolio to altcoins while maintaining exposure to stable assets such as Bitcoin or stablecoins. Third, consider staking opportunities and yield-generating platforms to maximize returns on your investments. Lastly, use analytical tools and resources to track market trends, ensuring you make informed decisions based on real-time data.

the altcoin market in 2024 is a mix of high-growth opportunities and challenges. Whether you are focusing on Solana’s scalability, XRP’s cross-border utility, or Chainlink’s oracle innovations, staying informed and adopting a disciplined investment strategy are vital.