The cryptocurrency market is no stranger to fluctuations, and Bitcoin has traditionally occupied the throne as the undisputed leader. However, recent trends indicate a significant shift as Ethereum starts outperforming Bitcoin in various metrics, including rising open interest in futures and options markets. This development signals a potential transformation in the market dynamics as investors increasingly recognize Ethereum’s unique capabilities and potential. This article delves into the factors contributing to Ethereum’s rising prominence and what this shift could mean for the future of cryptocurrencies.

Ethereum’s Rising Open Interest

One of the most notable indicators of Ethereum’s growing dominance is the surge in its open interest in futures and options contracts. Rising open interest generally indicates increasing confidence and participation in an asset. In the case of Ethereum, growing open interest reflects the increased participation of institutional investors and traders who believe it could be a suitable alternative to Bitcoin. Such growth is also reflected through the adoption of decentralized finance and non-fungible tokens, both of which are highly dependent on the blockchain of Ethereum.

One of the most notable indicators of Ethereum’s growing dominance is the surge in its open interest in futures and options contracts. Rising open interest generally indicates increasing confidence and participation in an asset. In the case of Ethereum, growing open interest reflects the increased participation of institutional investors and traders who believe it could be a suitable alternative to Bitcoin. Such growth is also reflected through the adoption of decentralized finance and non-fungible tokens, both of which are highly dependent on the blockchain of Ethereum.

Change in Investor Sentiment

The change in investor sentiment towards Ethereum is another important factor. Historically, Bitcoin has been perceived as “digital gold,” an asset to hedge against inflation and economic instability. While this narrative remains strong, Ethereum’s evolution into a multi-functional platform has captured the attention of a new wave of investors. With Ethereum 2.0 upgrades aimed to solve the problems of scalability and energy efficiency, it has even increased the appeal of the platform. The change from PoW to PoS consensus mechanism has also significantly reduced its energy consumption in addition to introducing staking rewards, which increases investment.

Not to be ignored is the continued rise of Ethereum in the DeFi sector. DeFi protocols involving decentralized lending, borrowing, and trading have grown explosively over the past few years. Being at the core of the DeFi ecosystem, Ethereum reaps enormous benefits from this trend. Further fueling this growth was the development of Layer 2 scaling solutions and sidechains, which further enhance usability and transaction efficiency on Ethereum.Market Dynamics and Competition

Another factor that is shifting this market is the growing competition within the cryptocurrency space. Although Bitcoin is first, there is a historical advantage in that regard, while newer platforms such as Ethereum have innovated new features that appeal to a larger audience. As a result, Ethereum’s ability to adapt and evolve has put it at a different level than other cryptocurrencies, including Bitcoin.

The adoption of blockchain technology among broader industrial applications such as gaming, supply chains, and finance has brought much prominence to programmable blockchains. With its capabilities for implementing smart contracts and developing tailor-made applications, Ethereum stands out ahead in innovation within blockchain.Whereas Bitcoin is comparably much narrower in scope, thus leaving the investment portfolios to venture more widely for other higher-growth assets.

What this Ominous for the Market

The implications of Ethereum outperforming Bitcoin are profound. If Ethereum continues to gain momentum, it could challenge Bitcoin’s dominance, leading to a more diversified cryptocurrency market. This shift could also attract more institutional investors who are looking for assets with strong growth potential and utility. Furthermore, the increasing adoption of Ethereum-based solutions across industries could pave the way for mainstream blockchain adoption, further solidifying its position as a market leader.

However, this does not necessarily mean that Bitcoin’s importance is being reduced. Its store of value role is still intact, and its limited supply is a factor that makes it an attractive hedge against inflation. Instead, the growing importance of Ethereum may mean that the market is maturing to where different cryptocurrencies are playing different roles, making the ecosystem more balanced.

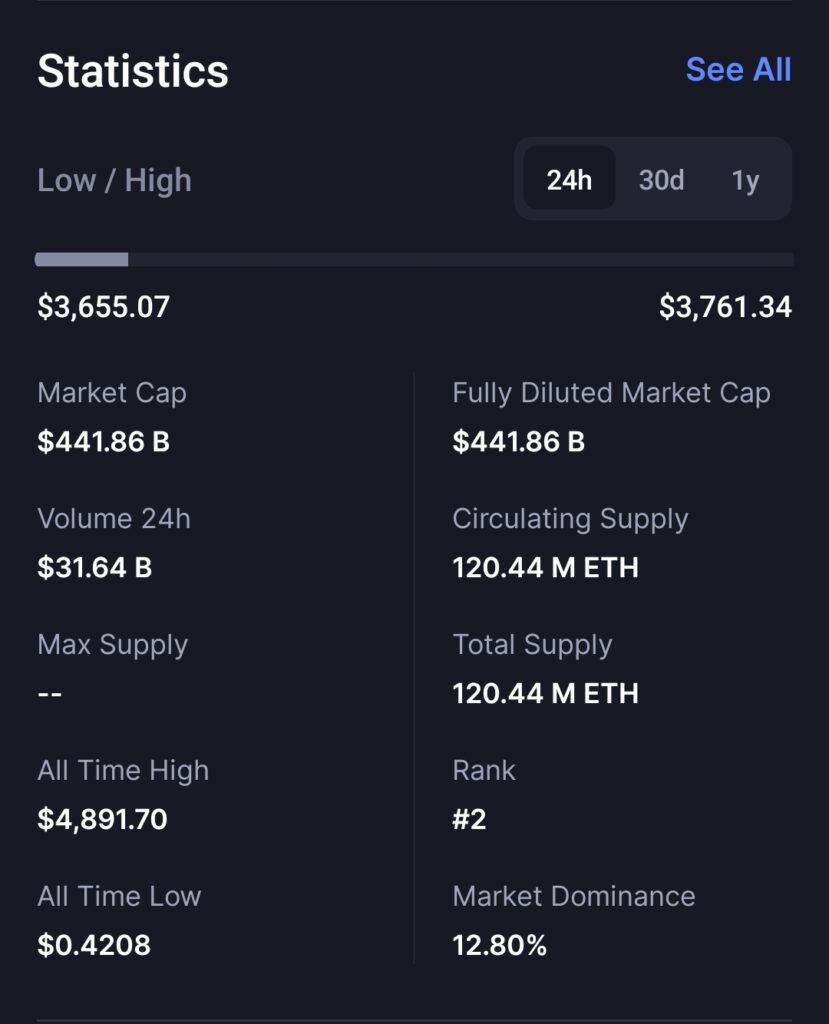

Ethereum or ETH has gained better performing status than that of its counterpart, Bitcoin or BTC, as seen in recent reports by Block Scholes and Bybit. Reports indicate a surge in the open interest for the underlying cryptocurrency, an aspect implying increased activity and confidence shown by investors towards the prospects of ETH.

Important Information from the Report

1. ETH Performing Better EndAccording to the report, Ethereum has outperformed Bitcoin in terms of price movements and market activity. This is mainly because ETH has been on the rise due to increased utility in decentralized finance (DeFi), non-fungible tokens (NFTs), and staking activities post-merge.

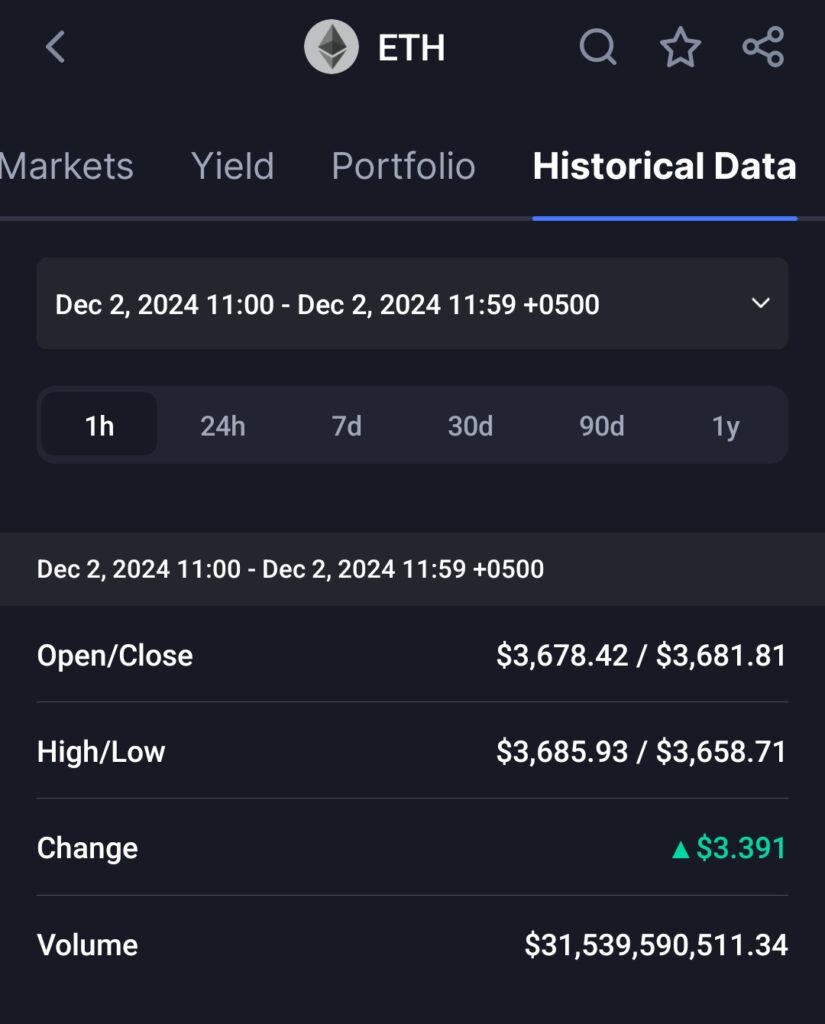

2. Open Interest IncreasingOpen interest, which measures the total number of outstanding derivative contracts, has risen sharply for Ethereum. This indicates that investors are indeed becoming more engaged and possibly optimistic about ETH’s future prospects.

3. BTC’s Steady GrowthWhile Bitcoin remains at the top, its growth pace has been steadier as compared to ETH. Still, the status of the former as a store of value and limited supply of BTC continues to attract a traditional investor, though of course, volatility in its price has been relatively subdued recently.

What Makes Ethereum Grows?

Staking. With the shift to the Ethereum 2.0, staking has opened up a new source of passive income for investors.

Institutional Adoption. Institutions are showing more interest in ETH due to its practical use cases in the blockchain ecosystem.

Innovative Applications: The growing DeFi landscape and the adoption of Layer 2 solutions have positioned Ethereum as a foundational technology.

Implications for the Crypto Market

Open interest in Ethereum has been increasing, which is a sign of increased risk appetite and a change in market sentiment. Traders and investors are diversifying their portfolios and are more interested in assets that have more utility and growth potential.

Conclusion

The Bybit x Block Scholes report points out the competitive advantage of Ethereum in the ever-changing crypto landscape. With its applications and strong market activity, ETH is proving to be a formidable contender against Bitcoin. As the crypto market matures, these trends may reshape the dynamics between the two leading cryptocurrencies.

The rising open interest and dominance in the cryptocurrency market of Ethereum indicate a critical shift in the market. As the investors and institutions realize more and more the value of this multi-functional platform, it is pretty evident that the dynamics of the crypto market are changing. Bitcoin is still a huge contender, but Ethereum’s utility-driven growth and adaptability make it a very strong contender for the space. It shows an emerging trend of a market where complexity and diversification can better appreciate innovation and utility. Further, it is to be observed how Bitcoin and Ethereum continue their duel and go on shaping the future of digital finance.